Regardless of your income or the size of your family, estate planning is something you do not want to neglect. For the most part, estate planning means determining and documenting your wishes for your children, and for managing your assets and liabilities when you pass. Your assets and liabilities will change throughout life, so may the size of your family. So, your estate plan should be updated periodically. At Gibbons’s Law Firm, we are very familiar with the process and have helped countless people put their affairs in order. Over the years, our estate planning attorneys at Lake of the Ozarks, have noticed that people have some misconceptions about some common estate planning tools. So, this week we wanted to talk about living wills and revocable trusts. If you would like to know what they are, what the differences are between them, when you should use each one, or if you need both, we invite you to read this blog.

Last Will and Testament

It sometimes surprises people to learn that having a will in place does not keep your estate from going through probate. It does, however, determine who should inherit your property if you pass away. But the most important aspect of a will is to appoint a guardian for your children. If something happens to you while your children are under the age of 18 a will can ensure who will be appointed to take care of your children. Because it is generally more straightforward and simpler, getting a will put in place is less expensive and takes less time than a revocable living trust. It also becomes public record upon your death.

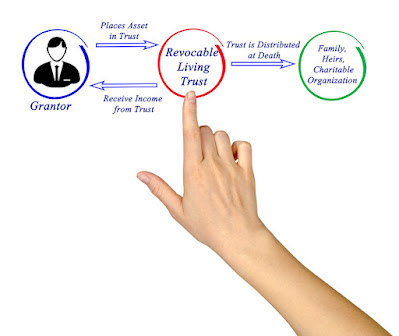

Revocable Living Trust

A revocable living trust is similar to a will, except it allows much more detail and control. You can use a revocable trust not only to determine that your children get your assets, but you can choose at what age you want your children to receive those assets. Some parents prefer their children to be at least 25 before having the responsibility of managing large amounts of money or valuable property. Because it is more complex, a revocable living trust can be more expensive and take more time to prepare. But it does allow your estate to avoid probate, which can make up for the initial cost. Probate procedures can take months or even years. With a revocable living trust, your assets can be transferred directly to your heirs without going through the probate process. Another difference is that a revocable living trust does not become public record upon your death the way a will does.

Gibbons Law Firm Can Help

Knowing whether you need a will or revocable living

trust, or both is something Gibbons Law Firm can help you with. Our mid-Missouri estate planning attorneys know how to keep your belongings out of probate

and ensure your wishes are honored. We are here to make it easy for you to plan

your estate and keep it up to date as your life changes. We encourage you to

call our law firm in lake Ozark to schedule a free consultation. We

would be happy to look at your situation and help create a plan to ensure that

you decide what happens to your children and assets if something happens to

you, not the courts. If you found this

blog helpful and would like to stay informed with all our latest announcements

and information, use the links below to follow us on social media!

Remember, your initial consultation with Gibbons Law Firm is always free.

No comments:

Post a Comment